|

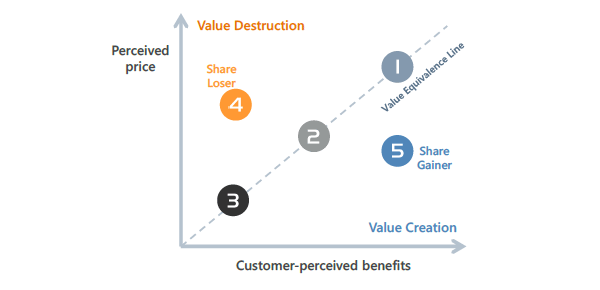

When businesses consider the purchase of a new product or service, price is undeniably a critical factor. However, decision-makers, influencers and specifiers in business-to-business markets don’t just buy on price; they also buy on benefits. The relationship between price and benefits has long been acknowledged for its importance, and was developed into a framework, the Value Equivalence Line (VEL), by McKinsey. The VEL illustrates the relationship between companies within a market, by showing their positioning based on each company’s perceived benefits and perceived price, relative to the perceived benefits and price of other companies in the same market. The actual Value Equivalence Line is the line at 45° between price perceptions and benefit perceptions, to which companies tend to gravitate. Companies to the left-hand side of the VEL will be at a competitive disadvantage given that their prices are seen as higher but their benefits weaker, and so they will lose market share. Conversely, those to the right-hand side of the VEL with lower prices and more benefits will win market share or be in a position where they can raise prices to capture more value. The Value Equivalence Line

While this framework is useful to show the relative positioning of companies diagrammatically on their perceived prices and benefits, it does not provide a metric on which companies can be measured and benchmarked. It also does not provide a single metric representing both price and benefits, i.e. value. In recognizing the need for a perceived value metric, B2B International created the Net Value Score (NVS). |

|

|

|

Considering Price And Benefits